Table of Content

In that way, you’ll know if you’re on track, or if you need to take extra steps to accelerate the process. The difference between the highest credit score range and the lowest credit score range translates into $266 per month, or $3,192 per year. Generally speaking, you’ll be limited to a modest loan amount, relative to the home prices in your area. As you can see, there are a significant numbers of approvals, regardless of credit score ranking.

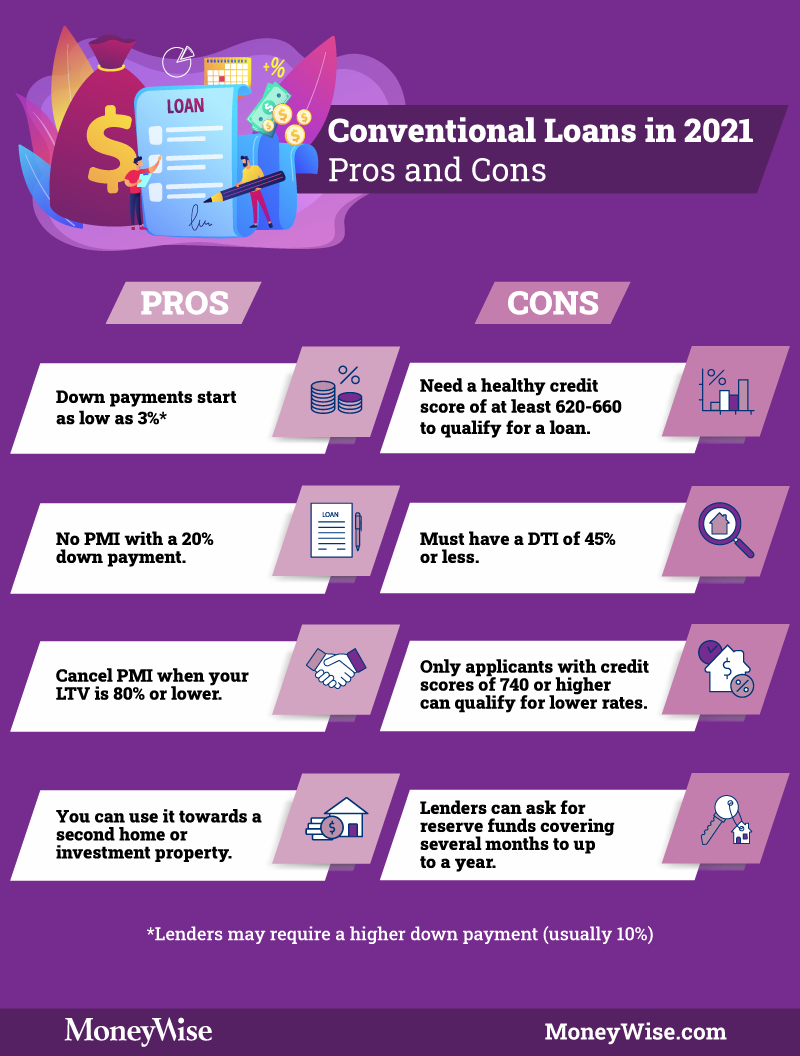

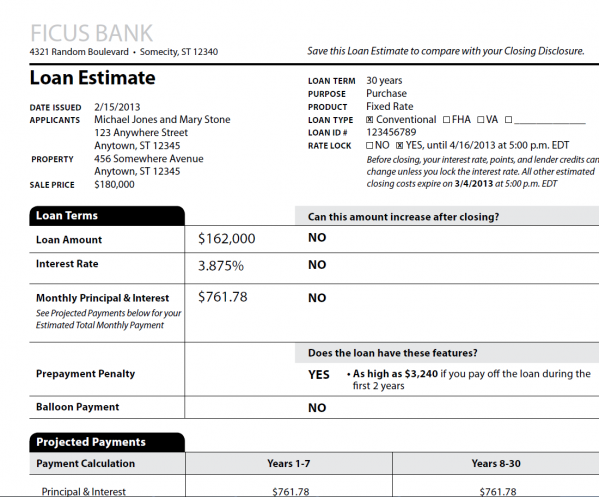

If you’re still debating the pros and cons of an FHA loan compared to a conventional loan, you should know that a conventional loan is not government-backed. Conventional loans are offered through Fannie Mae or Freddie Mac, which are government-sponsored enterprises that provide mortgage funds to lenders. If you have a higher score, you might be able to qualify with a higher debt-to-income ratio, or DTI. DTI refers to the percentage of your monthly gross income that goes toward paying debts.

Contact Us for Your FHA Loan

Interest rate and program terms are subject to change without notice. A credit score isn’t the only deciding factor on your mortgage application, but it’s a significant one. So when you’re house shopping, it’s important to know where your credit stands and how to use it to get the best mortgage rate possible. It’s easy to see that conventional mortgage loans and USDA mortgage loans are the big players in the game, representing nearly 75% of all mortgage loans approved in 2017. However, FHA loans were the third most approved type of loans, representing nearly 17% of all mortgage loans approved in 2017. In addition to lower interest rates, you can also enjoy lower costs on other fees like closing costs, mortgage insurance and others.

But don’t just think of FHA for credit issues as FHA is a great lending option for high score buyers too. We have a lot of helpful articles to help buyers, homeowners, and Realtors. If you’re looking to get a cash-out refinance, you can do so with an FHA loan. Rocket Mortgage requires a minimum median credit score of 620 for an FHA cash-out refinance. The FHA does require that if you convert your property value into cash, you leave at least 15% equity in your home.

Explore business banking

The FICO® score is a number that represents a potential borrower's creditworthiness. FICO® is a data analytics company which uses consumer credit files collected from different credit bureaus to compute their scores. Now, let’s see what types of loans were being approved in 2017. The FHA Loan is the type of mortgage most commonly used by first-time homebuyers and there's plenty of good reasons why. The higher your score and the higher your down payment, the better interest rate you can expect.

FHA loans are so called because they are insured by the Federal Housing Administration, a US government agency operating under Housing and Urban Development . Because they’re subject to government-provided mortgage insurance, credit score requirements are more relaxed. And for that reason, FHA mortgages are more popular among borrowers with fair credit. With the exception of jumbo mortgages, conventional mortgages are the most credit score sensitive mortgage types. However, lenders may impose a somewhat higher credit score if your loan application contains other risk factors. That may include a minimum down payment, a cash-out refinance, or a high debt-to-income ratio .

Estás ingresando al nuevo sitio web de U.S. Bank en español.

Most conventional mortgage loans, for example, require a minimum credit score of at least 620; however, FHA minimum credit score requirements are more lenient. The minimum credit score needed for most mortgages is typically around 620. However, government-backed mortgages like Federal Housing Administration loans typically have lower credit requirements than conventional fixed-rate loans and adjustable rate mortgages . Ourmortgage loan officerscan help you figure out what mortgage options would best fit your situation and lifestyle. If you’re looking to buy a home, FHA loans with low down payments may be an attractive option to consider. To qualify for an FHA-insured loan, you need a minimum credit score of 580 for a loan with a 3.5% down payment, and a minimum score of 500 with 10% down.

However, many FHA lenders require credit scores of at least 620. FHA loans have historically helped low- to moderate-income families attain homeownership – hence, the low down payment. They may also allow for more lenient credit scores than the minimum 620 FICO score typically required for many conventional home loans. To qualify for an FHA loan with a 3.5% down payment, for example, you’ll need a minimum FICO credit score of 580. If your credit score is lower – between 500 and 579 – you may still be eligible for an FHA loan, but you’ll need to make a higher down payment of 10%. If not able to use a VA or USDAno money down purchase loan, FHA could be the next best thing.

A mortgage calculator can help you estimate your monthly payments, and you can see how your down payment amount affects them. There are a few more specific conditions to qualify, including a down payment amount, mortgage insurance, credit score, loan limits and income requirements. Mostly, the FHA requirements to qualify for a mortgage are the same for DACA recipients. FHA loans are available with low down payment options and lower minimum credit score limits, but you’ll also have to pay mortgage insurance.

It’s worth noting that if you have a score that low, you’ll need to keep an equally low DTI. Rocket Mortgage requires a ratio of no more than 38% before your mortgage payment is included, and no more than 45% after the inclusion of your payment. The type of FHA loan you choose limits the type of home you can buy and how you can spend the money you receive. This makes it especially important to be sure that you’re getting the right type of loan. If none of the following loan types match your goals, you might want to consider another type of government loan.

Even among those consumers with a credit score lower than 550, the approval rating was nearly 40%. FHA.com is a privately-owned website that is not affiliated with the U.S. government. This program lets buyers get a single loan with just one closing.

In addition to the restrictions laid out above, it’s important to note that very few lenders offer these subprime FHA loans and they may have stricter requirements than what the FHA sets. At Rocket Mortgage, you have to have a median FICO® Score of at least 580 to qualify and may need to have a DTI as low as 38%. If the lender finds three different credit scores for one borrower, it will use the middle value when determining your loan eligibility. If the lender finds only two credit scores, it will use the lower of the two options. Here’s what you need to know about FHA loan credit score requirements for 2022.

The minimum credit score for an FHA loan is 500 and the maximum credit score is 579. Borrowers with a credit score over 580 may qualify for an FHA loan with a 3.5% down payment. Borrowers with a credit score below 580 will need at least a 10% down payment.

Depending on where you live or where you’re looking to buy a house, your mortgage lender can help you determine what your maximum limit will be for the current year. Remember, you're not borrowing money from the Federal Housing Administration. So you have to meet the lender's minimum credit-score requirements in addition to HUD's guidelines. The FICO score on your credit report isn’t the only factor the FHA considers. The agency also looks at your payment history and any past history of bankruptcies and foreclosures.

Other Factors that Affect Your Eligibility for an FHA Loan

Alternative credit is a way of proving a more solid or in depth payment history than the credit report shows. The logic here is that if you have a more affordable payment, you’re more likely to be able to stay in your home and pay it off, which is good for the FHA. You’ll also usually be able to get a lower mortgage insurance rate as the MIP for FHA Streamlines is 0.55% of your overall loan amount annually. When it comes to purchasing a home, you can get in with a little as 3.5% down if you have a median FICO® Score of 580.

FHA loans offer low interest rates to help homeowners afford their monthly housing payments. This is a great benefit when compared to the negative features of subprime mortgages. Your score is influenced by many factors, but the two biggest are whether you pay your bills on time and how much debt you owe. Having a credit score based on these factors gives lenders a quick way to see if you’re likely to pay your future bills – like your mortgage, for example.

No comments:

Post a Comment